what is tax planning uk

Ad Need Software for Making Tax Digital. Business Property Relief BPR Business Relief reduces the value of a business or its assets when working out how much Inheritance Tax has to be paid.

Tax Planning For Uk Investments Capital Gains Tax Htj Tax

Tax planning is the legal arrangement of your financial affairs to ensure your tax liabilities are minimised.

. Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. Tax planning is also necessary for individuals who face their own challenges owning managing. Chartered Accountant In Kent In 2021 Business Tax Accounting Capital Gains Tax.

PM preparing corporation tax U-turn amid backbench rebellion. Tax planning or analysis is a lawful method to reduce tax liabilities over a calendar year by capitalizing on tax deductions benefits and exemptions. Tax planning is the analysis of a clients overall financial situation and conditions in order to craft a financial plan that can be executed in the most tax-efficient manner.

It is important to note this is not tax avoidance. Use HMRC-approved software such as Xero. Ad Talk To Us About Taking Advice - Financial Planning Advice Thats Always On Your Terms.

Tax planning UK considerations. When you have a plan for your property that involves the process of house flipping and then letting the same house to tenants you will be liable to pay capital tax gains at the rate of 20 per. Ad From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around.

Tax planning refers to the process of minimising tax liabilities. Heres a rundown of the most common tax planning UK. 1354 Matt Mathers.

It assists the taxpayers in obtaining. How can Hall Wilcox help. Tax planning refers to the process of minimising tax liabilities.

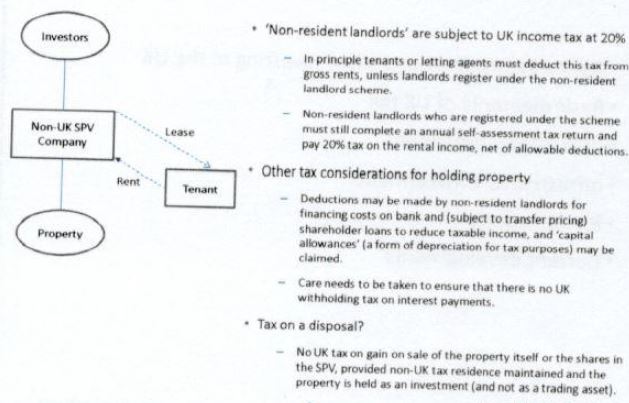

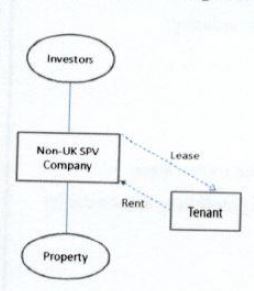

VAT submission is simple with Xero online accounting software Sign up now. Careful tax planning is critical for business success in an unpredictable global economy. This article will explore and inform about how the UK tax system works for non-nationals looking to move to the UK to live and work or are eying to invest there.

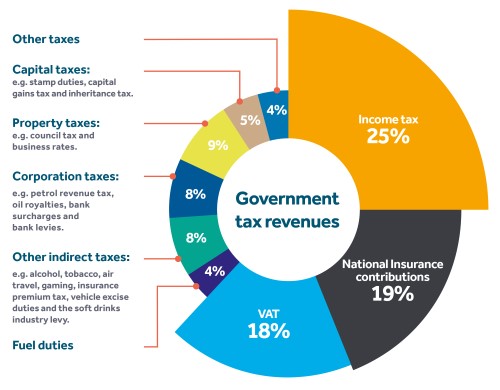

The amount of Inheritance Tax due varies according to the value of your estate. The tax typically applies to worldwide income. No matter the structure there are a few key types of taxes that you should be aware of.

Book Free Call Back From Our Advisory Helpdesk To Determine If Advice Is Right For You. Liz Truss is considering a U-turn on her plan to cut corporation tax amid a growing. Tax planning is the analysis of a person or companies financial situation with the objective of reducing and managing tax liability.

In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances. Tax planning involves applying legal provisions that. Tax planning is the process of analyzing a persons financial situation and applying strategies to pay the lowest amount of taxes based on their facts and circumstances.

Everyone has to pay some form of. VAT submission is simple with Xero online accounting software Sign up now. 1 day agoBritish Prime Minister Liz Truss is not planning any further changes to her economic plan and she has full confidence in the OBR independent forecaster to do its work accurately.

What does tax planning mean. Use HMRC-approved software such as Xero. Ad Need Software for Making Tax Digital.

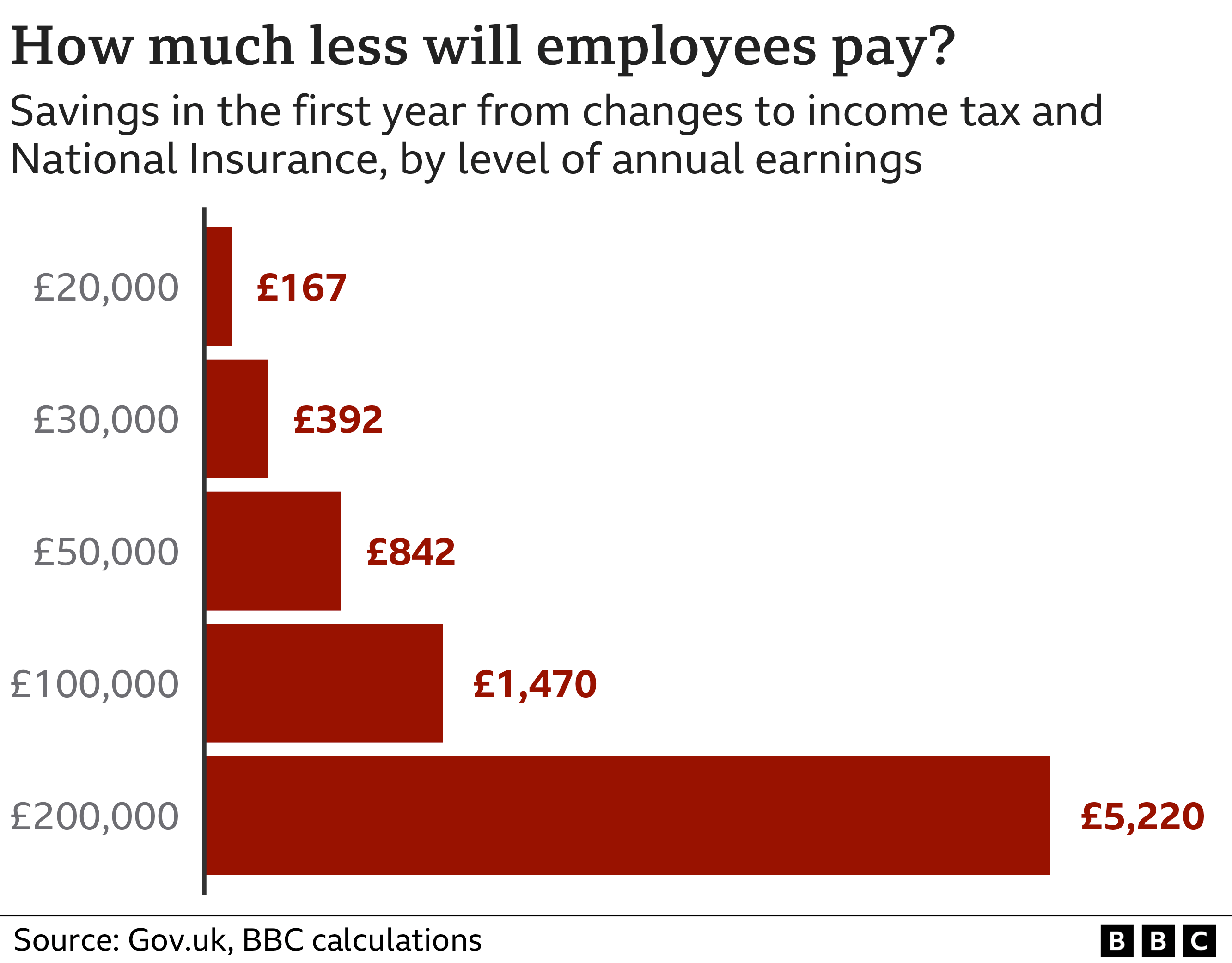

In other words you want to reduce what you owe on your tax bills by taking advantage of any. This article was written by James Whiley who is admitted as a solicitor in New South Wales and England and Wales and practiced in tax and. 2 days agoThe spokesperson said the government was still committed to the mini-budget measures in particular cutting the basic rate of income tax to 19p in the pound and not.

Any assets valued above the 320000 for an individual and 650000 for a couple nil-rate band. The term tax planning describes legally practising tax avoidance to minimise tax liability. Careful tax planning allows you to take advantage of opportunities which minimise.

Tax planning is the legal process of arranging your affairs to minimise a tax liability. Get Support And Advice From The UKs Leading Independent Holiday Letting Agency. Tax planning is all about putting into place a strategy which provides the.

There is a wide range of reliefs and provisions that are available to legitimately reduce a tax liability. Any ownership of a business or. Taking advantage of year-end tax planning should only be part of your overall tax planning strategy.

In some countries income tax rates can exceed 50 and are imposed on a progressive scale with higher rates applying to higher earnings.

2021 Year End Tax Planning 7 Top Tips Blick Rothenberg

Starbucks Uk Tax Dodge Highlights Flaws Of Territorial Taxation Center On Budget And Policy Priorities

Inheritance Tax Planning October 2022 Uk Guide

Tax Planning Ideas Martin Aitken Co Chartered Accountants

Inheritance Tax Key Figures At A Glance The Private Office

Tax Planning For Uk Investments Stamp Duty Htj Tax

Pdf Tax Planning Corporate Governance And Firm Value

Using Uk Entities For Tax Planning In Latvia S Context

Stream Episode Inheritance Tax Planning Top 10 Tips By The Legal Room Uk Podcast Listen Online For Free On Soundcloud

9780754513377 International Tax Planning Personal Taxes Abebooks 0754513378

Chancellor Kwasi Kwarteng Hails New Era As He Unveils Tax Cuts Bbc News

Energy Bill Water Bill And Council Tax Planner Stickers Uk Etsy

Uk Trusts As An Effective Tax Planning Tool B4

A Uk Outlook Essential Tax Planning For Uk Inheritance Tax And Domicile Britcham Singapore Youtube

Bates Weston Company Tax Planning Guide Bates Weston

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Tax Planning 28 V3 Handbook Of Financial Planning And Control

U S U K Tax Planning Coping With Uncertainty Ruchelman P L L C